How To Apply For Ontario Energy And Property Tax Credit . ontario energy and property tax credit. the ontario trillium benefit combines the following three credits to help pay for energy costs as well as sales and property tax:. 2022 ontario energy and property tax credit (oeptc) calculation sheets. the first monthly 2023 ontario trillium benefit payment, which includes any oeptc entitlement, will be issued on july. how do you receive the ontario trillium benefit? If you are eligible for the ontario energy and property tax. to apply for the otb or oshptg, if you live in ontario, search for “trillium” in the search box and select the ontario trillium. File your tax return to claim the ontario trillium benefit, even if you do not have any income. to apply for the ontario energy and property tax credit:

from www.ontario.ca

ontario energy and property tax credit. how do you receive the ontario trillium benefit? File your tax return to claim the ontario trillium benefit, even if you do not have any income. the first monthly 2023 ontario trillium benefit payment, which includes any oeptc entitlement, will be issued on july. to apply for the ontario energy and property tax credit: to apply for the otb or oshptg, if you live in ontario, search for “trillium” in the search box and select the ontario trillium. 2022 ontario energy and property tax credit (oeptc) calculation sheets. the ontario trillium benefit combines the following three credits to help pay for energy costs as well as sales and property tax:. If you are eligible for the ontario energy and property tax.

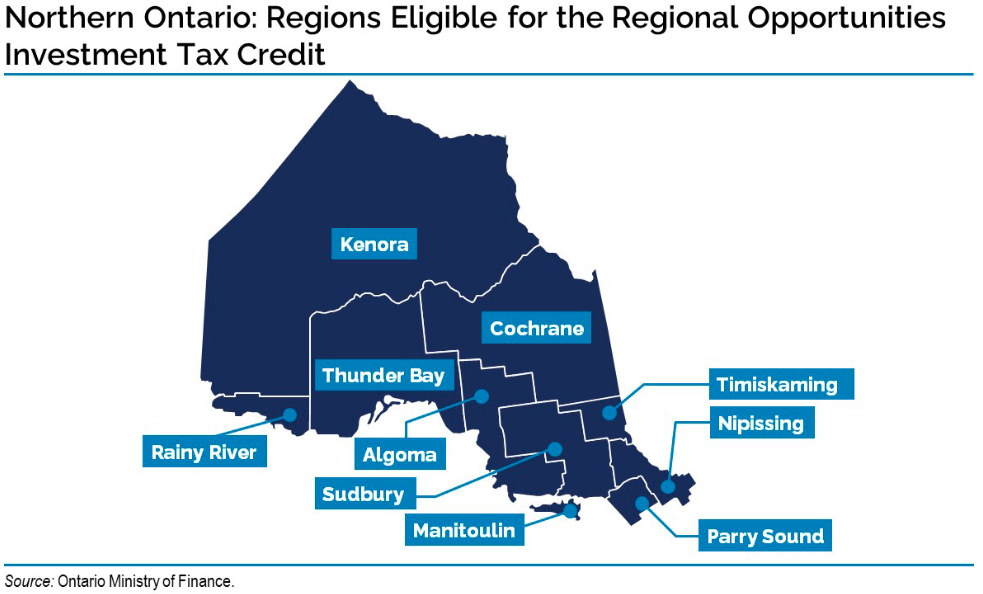

Technical bulletin Ontario Regional Opportunities Investment Tax Credit Regional

How To Apply For Ontario Energy And Property Tax Credit to apply for the ontario energy and property tax credit: how do you receive the ontario trillium benefit? the first monthly 2023 ontario trillium benefit payment, which includes any oeptc entitlement, will be issued on july. File your tax return to claim the ontario trillium benefit, even if you do not have any income. the ontario trillium benefit combines the following three credits to help pay for energy costs as well as sales and property tax:. 2022 ontario energy and property tax credit (oeptc) calculation sheets. If you are eligible for the ontario energy and property tax. to apply for the ontario energy and property tax credit: to apply for the otb or oshptg, if you live in ontario, search for “trillium” in the search box and select the ontario trillium. ontario energy and property tax credit.

From rwcnj.com

4 Home Improvement Projects that Qualify for Energy Tax Credits RWC How To Apply For Ontario Energy And Property Tax Credit If you are eligible for the ontario energy and property tax. to apply for the otb or oshptg, if you live in ontario, search for “trillium” in the search box and select the ontario trillium. to apply for the ontario energy and property tax credit: the ontario trillium benefit combines the following three credits to help pay. How To Apply For Ontario Energy And Property Tax Credit.

From eyeonhousing.org

New Residential Energy Tax Credit Estimates Eye On Housing How To Apply For Ontario Energy And Property Tax Credit 2022 ontario energy and property tax credit (oeptc) calculation sheets. the first monthly 2023 ontario trillium benefit payment, which includes any oeptc entitlement, will be issued on july. how do you receive the ontario trillium benefit? the ontario trillium benefit combines the following three credits to help pay for energy costs as well as sales and. How To Apply For Ontario Energy And Property Tax Credit.

From www.windowworld.com

Energy Efficient Home Improvement Credit Explained How To Apply For Ontario Energy And Property Tax Credit 2022 ontario energy and property tax credit (oeptc) calculation sheets. to apply for the ontario energy and property tax credit: If you are eligible for the ontario energy and property tax. the first monthly 2023 ontario trillium benefit payment, which includes any oeptc entitlement, will be issued on july. ontario energy and property tax credit. File. How To Apply For Ontario Energy And Property Tax Credit.

From www.novoco.com

The Inflation Reduction Act An Overview of Clean Energy Provisions and Their Impact on How To Apply For Ontario Energy And Property Tax Credit ontario energy and property tax credit. to apply for the ontario energy and property tax credit: to apply for the otb or oshptg, if you live in ontario, search for “trillium” in the search box and select the ontario trillium. File your tax return to claim the ontario trillium benefit, even if you do not have any. How To Apply For Ontario Energy And Property Tax Credit.

From www.cielpower.com

2022 Tax Credits for Residential Energy Efficiency Improvements — Ciel Power LLC Insulation How To Apply For Ontario Energy And Property Tax Credit If you are eligible for the ontario energy and property tax. to apply for the otb or oshptg, if you live in ontario, search for “trillium” in the search box and select the ontario trillium. the ontario trillium benefit combines the following three credits to help pay for energy costs as well as sales and property tax:. . How To Apply For Ontario Energy And Property Tax Credit.

From www.formsbirds.com

Form 5695 Residential Energy Credits (2014) Free Download How To Apply For Ontario Energy And Property Tax Credit File your tax return to claim the ontario trillium benefit, even if you do not have any income. 2022 ontario energy and property tax credit (oeptc) calculation sheets. the ontario trillium benefit combines the following three credits to help pay for energy costs as well as sales and property tax:. to apply for the ontario energy and. How To Apply For Ontario Energy And Property Tax Credit.

From eapon.ca

Ontario’s New Personal Tax Credits Elder Abuse Prevention Ontario How To Apply For Ontario Energy And Property Tax Credit ontario energy and property tax credit. how do you receive the ontario trillium benefit? to apply for the otb or oshptg, if you live in ontario, search for “trillium” in the search box and select the ontario trillium. 2022 ontario energy and property tax credit (oeptc) calculation sheets. the ontario trillium benefit combines the following. How To Apply For Ontario Energy And Property Tax Credit.

From wowa.ca

Work From Home Tax Credit Guide WOWA.ca How To Apply For Ontario Energy And Property Tax Credit the ontario trillium benefit combines the following three credits to help pay for energy costs as well as sales and property tax:. File your tax return to claim the ontario trillium benefit, even if you do not have any income. If you are eligible for the ontario energy and property tax. to apply for the ontario energy and. How To Apply For Ontario Energy And Property Tax Credit.

From airprosusa.com

Energy Tax Credits for 2023 How To Apply For Ontario Energy And Property Tax Credit to apply for the ontario energy and property tax credit: 2022 ontario energy and property tax credit (oeptc) calculation sheets. File your tax return to claim the ontario trillium benefit, even if you do not have any income. how do you receive the ontario trillium benefit? the ontario trillium benefit combines the following three credits to. How To Apply For Ontario Energy And Property Tax Credit.

From onesourcehomeservice.com

Energy Tax Credits for 2023 One Source Home Service How To Apply For Ontario Energy And Property Tax Credit If you are eligible for the ontario energy and property tax. 2022 ontario energy and property tax credit (oeptc) calculation sheets. the ontario trillium benefit combines the following three credits to help pay for energy costs as well as sales and property tax:. the first monthly 2023 ontario trillium benefit payment, which includes any oeptc entitlement, will. How To Apply For Ontario Energy And Property Tax Credit.

From www.fullerhvac.com

Take Advantage of Federal Tax Credits for HVAC Systems in 2023 How To Apply For Ontario Energy And Property Tax Credit to apply for the ontario energy and property tax credit: If you are eligible for the ontario energy and property tax. the first monthly 2023 ontario trillium benefit payment, which includes any oeptc entitlement, will be issued on july. to apply for the otb or oshptg, if you live in ontario, search for “trillium” in the search. How To Apply For Ontario Energy And Property Tax Credit.

From taxfoundation.org

Electric Vehicles EV Taxes by State Details & Analysis How To Apply For Ontario Energy And Property Tax Credit 2022 ontario energy and property tax credit (oeptc) calculation sheets. the first monthly 2023 ontario trillium benefit payment, which includes any oeptc entitlement, will be issued on july. If you are eligible for the ontario energy and property tax. ontario energy and property tax credit. to apply for the ontario energy and property tax credit: . How To Apply For Ontario Energy And Property Tax Credit.

From detroitmi.gov

Earned Tax Credit City of Detroit How To Apply For Ontario Energy And Property Tax Credit to apply for the otb or oshptg, if you live in ontario, search for “trillium” in the search box and select the ontario trillium. If you are eligible for the ontario energy and property tax. the ontario trillium benefit combines the following three credits to help pay for energy costs as well as sales and property tax:. . How To Apply For Ontario Energy And Property Tax Credit.

From www.lindstromair.com

What does the Energy Property Tax Credit Mean for Me? Lindstrom Air Conditioning & Plumbing How To Apply For Ontario Energy And Property Tax Credit the first monthly 2023 ontario trillium benefit payment, which includes any oeptc entitlement, will be issued on july. ontario energy and property tax credit. 2022 ontario energy and property tax credit (oeptc) calculation sheets. to apply for the ontario energy and property tax credit: how do you receive the ontario trillium benefit? to apply. How To Apply For Ontario Energy And Property Tax Credit.

From www.mstiller.com

Residential energy credits enhancing efficiency and saving on taxes How To Apply For Ontario Energy And Property Tax Credit 2022 ontario energy and property tax credit (oeptc) calculation sheets. how do you receive the ontario trillium benefit? to apply for the otb or oshptg, if you live in ontario, search for “trillium” in the search box and select the ontario trillium. ontario energy and property tax credit. the ontario trillium benefit combines the following. How To Apply For Ontario Energy And Property Tax Credit.

From fcpp.org

2021 Provincial Tax Rates Frontier Centre For Public Policy How To Apply For Ontario Energy And Property Tax Credit how do you receive the ontario trillium benefit? the first monthly 2023 ontario trillium benefit payment, which includes any oeptc entitlement, will be issued on july. File your tax return to claim the ontario trillium benefit, even if you do not have any income. the ontario trillium benefit combines the following three credits to help pay for. How To Apply For Ontario Energy And Property Tax Credit.

From twitter.com

Ontario Energy on Twitter "Attention Seniors you may be eligible for up to 1,247 on your 2022 How To Apply For Ontario Energy And Property Tax Credit how do you receive the ontario trillium benefit? ontario energy and property tax credit. 2022 ontario energy and property tax credit (oeptc) calculation sheets. to apply for the ontario energy and property tax credit: File your tax return to claim the ontario trillium benefit, even if you do not have any income. the first monthly. How To Apply For Ontario Energy And Property Tax Credit.

From blog.turbotax.intuit.com

Residential Energy Efficient Property Tax Credit Helps You Go Green and Get More Green at Tax How To Apply For Ontario Energy And Property Tax Credit how do you receive the ontario trillium benefit? to apply for the otb or oshptg, if you live in ontario, search for “trillium” in the search box and select the ontario trillium. the first monthly 2023 ontario trillium benefit payment, which includes any oeptc entitlement, will be issued on july. ontario energy and property tax credit.. How To Apply For Ontario Energy And Property Tax Credit.